Blue On Blue

Universal Display began reporting commercial revenue from phosphorescent emitters in late 2005, primarily from its red emitter. Previously the company’s sales came from developmental materials sold to customers and developmental contracts. The first color OLED smartphone was the Samsung (005930.KS) X120, released in 1Q 2004, which had a 1.8” OLED display, was able to reproduce 65,000 colors, with a resolution of 128 x 128 pixels., and the following year BenQ (2352.TT) released the A520, which sported a 1.5” OLED display (128 x 128) and a smaller 96 x 96 display. To compare that to what is available currently, the Xiaomi (1810.HK) 14 Pro released this month has a 6.73” OLED display that can reproduce 68 billion colors and has a resolution of 3200 x 1440 pixels.

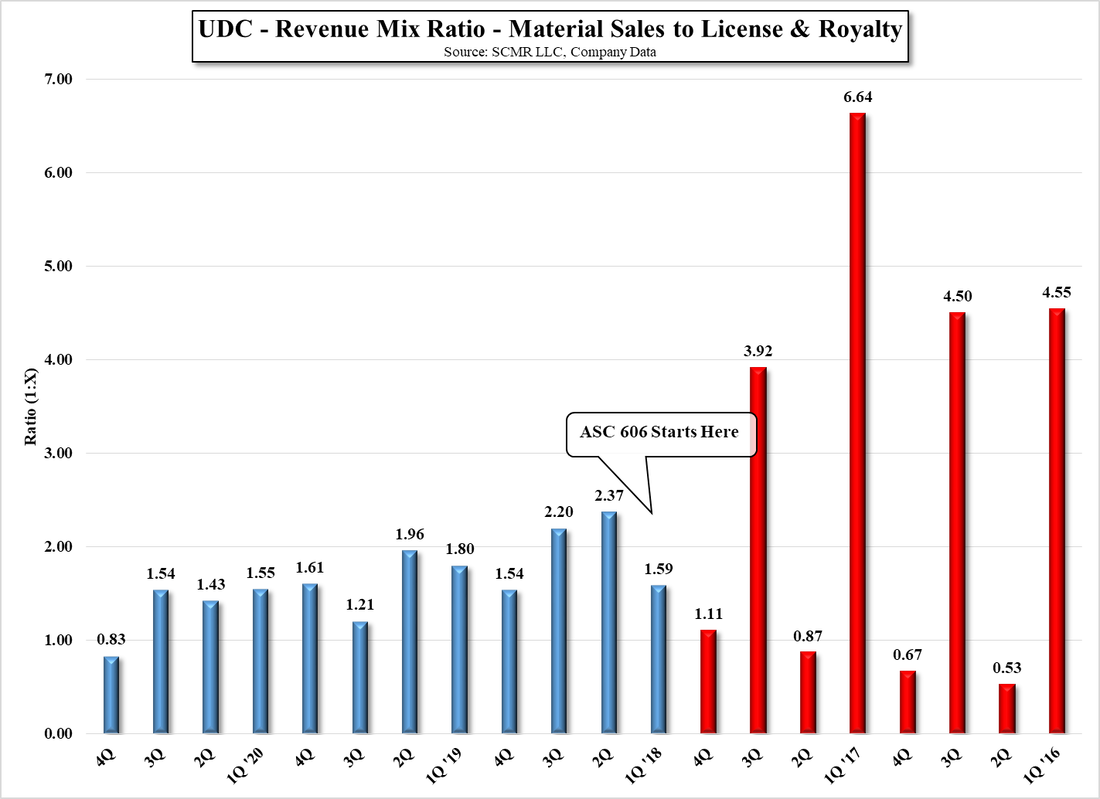

We have been tracking sales of Universal Display’s OLED materials for more than 10 years and while the company announced its first commercial green phosphorescent green emitter material in the summer of 2010, Samsung Display, UDC’s biggest customer did not release a smartphone using both red and green phosphorescent emitters until the Galaxy S4 in April of 2013, almost 3 years later. We expect Samsung Display had integrated the green emitter into the display stack for some time before the stack was stable enough to be used commercially, and while the OLED industry is far more adept at making stack material changes, we expect there will be a learning curve with blue phosphorescent emitter material when it is made available commercially.

At a seminar yesterday in South Korea, UBI research, a local consultancy, stated that Samsung Display had set a goal of applying blue phosphorescent OLED material to devices in the 2nd half of 2025, rather than in mid-2024 as previously expected. We believe this is in reference to materials being developed by SDC, and while we assume they are working with UDC on that development, that remains unconfirmed. UBI went on to state that they believed the current version of SDC’s blue phosphorescent emitter material is not efficient enough to be used as is, although they believe that SDC would be willing to use a more efficient version, even if the lifetime was only 55% of the fluorescent emitter materials it will replace. Given that color point (deep blue), efficiency, and lifetime are all variables that determine the commercial success of an emitter material, it has been difficult to ‘blend’ the three major parameters to create a commercially viable blue phosphorescent emitter material.

To complicate matters further, the other components of the OLED stack, most of which are developed and produced by other material suppliers, must also work efficiently with the OLED emitter materials, and that combination must be formulated by the panel producer. UDC and others will develop their blue phosphorescent emitter with host materials, but there are typically at least 4 layers (usually more) of additional materials that create the environment under which the emissive materials work best, so even if a panel producer decides to use a commercial blue phosphorescent emitter, all of the layers in the stack are likely to be redesigned to produce the most efficient stack combination, a time consuming task, and one that involves considerable testing.

Why Blue? The quest for a blue phosphorescent emitter material is not a frivolous one, as a proper phosphorescent blue emitter will improve the stack’s power efficiency. Estimates seem to range for an improvement of between 20% and 35%, although we expect that the actual result will depend on both the blue material specs and the other stack emitters and materials. Anything that can reduce the power consumption of a mobile device is of immense value to device designers who can add additional hardware or functionality or reduce the size of the battery, while maintaining or improving the overall display specifications.

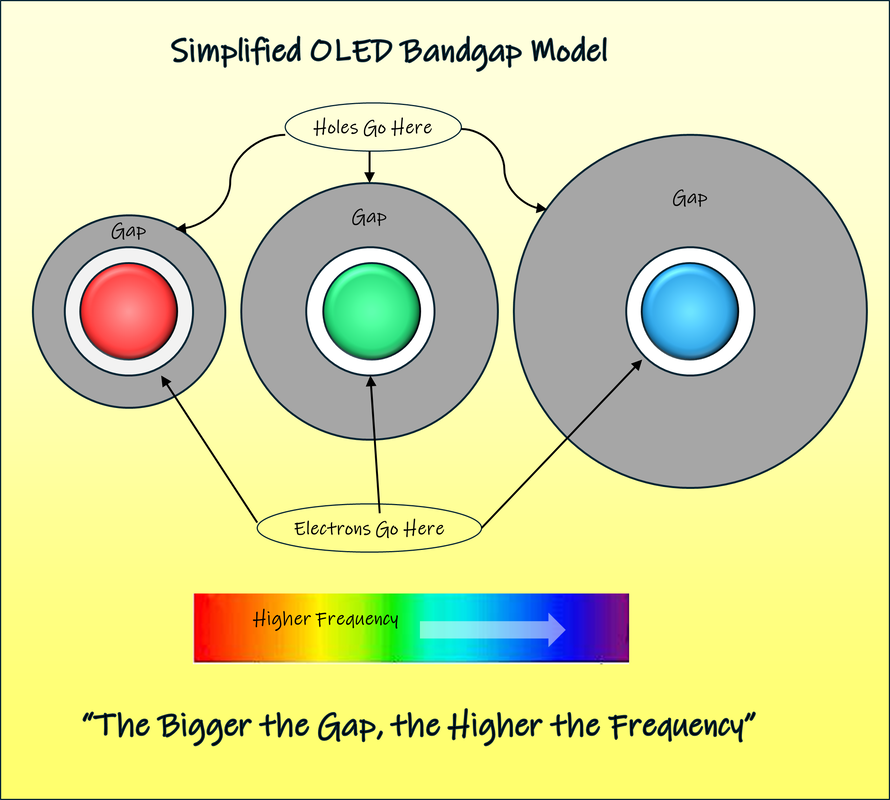

Why has it been so hard? UDC and others have been on the trail of a blue phosphorescent emitter material for almost as long as commercial OLED materials have been around, but like other ‘blue’ structures, such as blue LEDs, the characteristics that create blue light are specific to what are known as ‘high bandgap’ materials. In an OLED device, ‘holes’ (think: ‘anti-electrons’) are injected into the stack at the Highest Occupied Molecular Level (HOMO), while electrons are injected at the Lowest Unoccupied Molecular Level (LUMO), with the space between those two ‘points’ called the bandgap. As the world of electronics always strives toward a neutral state, the two ‘migrate’ to the bandgap mid-point and when they pair, they release light energy and cancel each other. The frequency (color) of that light energy is proportional to the size of the ’gap’ between HUMO and LUMO, with larger gaps creating higher (blue) frequencies and small gaps creating lower (red) frequencies.

Unfortunately, the larger the bandgap, the more unstable the materials tend to be, which means they have short lifetimes, just as in nature animals or insects with high metabolic rates tend to have shorter lifetimes than those with slower rates, and this has been a fundamental problem for OLED material scientists. In theory, a lighter blue should be more stable and have a longer lifetime, but a deep blue is essential to balance the phosphorescent red and green already being used in RGB OLED displays, so the quest to find a material with a large bandgap with a stable structure continues. Eventually a material will be found that meets the necessary criteria, but once it becomes commercialized, it will take time to find its way into OLED stack, just the way green phosphorescent emitter material did, along with the more predictable issues surrounding cost, availability, and IP that overhang current OLED emitter materials. It’s coming and its going to create a stir when it does, but aside from the initial hoopla, blue phosphorescent OLED emitter material is just a part of the OLED stack and will be subject to the same starts and stops as other OLED materials.

RSS Feed

RSS Feed